BullionVault review: how the platform to buy gold, silver and platinum works

Buying gold with the BullionVault platform can be an opportunity if you want to invest in precious metals safely and at affordable prices. It is known that gold, silver, platinum and palladium are considered anti-inflation assets .

What exactly is BullionVault? It is a platform through which you can have the price of precious metals in real time and carry out the sale. The great advantage is to carry out direct transactions by obtaining the ownership of a certain amount of physical metal , which you can store in the vault of the platform, in complete safety.

You will also have the opportunity to transform gold or silver into liquidity at any time, as well as platinum and palladium. All while managing your money online. Want to find out how BullionVault works and what are the benefits? Read our article.

How BullionVault works

Let's start the BullionVault review by focusing on what was the reason that led to its creation. The platform went online in 2005 as a development of the Galmarley Ltd company , which specializes in the sale of precious metals.

The idea was born in wanting to offer a service that would allow anyone to invest in physical gold. Before BullionVault, buying physical gold or other precious metals was not an easy thing, as well as involving high costs, as you had to go to intermediaries in the sector.

The BullionVault platform fits into this perspective. You can use any currency to buy precious metals at competitive costs and starting from a minimum investment of € 100 . Plus, you won't have to worry about where to store your gold bars, as BullionVault itself will offer you a vault service .

In addition, you will have all the information to buy and sell precious metals at the most suitable time. This is possible thanks to the fact that the platform provides you with a real-time chart of gold, silver, platinum and palladium.

BullionVault: is it safe?

With BullionVault, the gold and silver you buy are safe. In fact, since 2008 the company is part of the LBMA association, an acronym that identifies the London Bullion Market Association , the main association that regulates the physical gold market. Furthermore, the company has shown that it is based on a careful governance that has been able to manage growth well with constant profits over the years.

Today BullionVault has more than 100 million physical precious metals investments, with over 3.8 billion customer capital . To date, more than 100,000 users in over 175 countries around the world rely on the platform for the purchase and sale of precious metals.

BullionVault Review: Gold Price Chart

As you read, BullionVault's idea is to make it easier to buy precious metals. For this you will have the possibility to view the real-time price of gold . In particular, the graph that you will arrange within the platform indicates the price of professional gold .

This term identifies the one established at the London market every day. The quote updates automatically every 5 seconds. In addition, you will have a historical view of the trend of the precious metal, since the chart provides the price of the last 20 years. You will also have the option to choose the currency you prefer from the euro to the dollar.

BullionVault review: costs

| Types of operation | Cost |

| Registration | free |

| Purchase and sale | and 0.50% and 0.05% |

| Insurance and custody | 0.12% |

| Converting gold into your own currency | free |

| Daily statement of vaulted rooms | free |

| Withdrawal | and 20€ at 30€ |

Registering on the platform is free, but there are costs involved . Here are the main ones:

- purchase and sale commission;

- custody and insurance costs;

- transfer costs.

Each trade you make is subject to a fee that will vary based on the volume of the transaction. In fact, every time you buy or sell gold, the invested sum will be added to the previous one, allowing you to scale the percentage of commissions you will have to the platform.

Therefore, on the first € 75,000, a cost per transaction of 0.50% is applied , which drops to 0.10% if you carry out transactions between € 75,000 and € 750,000. Finally, if you exceed this figure, a cost of 0.05% per operation will be applied.

The other aspect to consider is the custody and insurance costs . In fact, as we will analyze in the next paragraphs, when you buy physical gold or other precious metals, these will be deposited in real vaulted rooms .

The custody service provides for a commission of 0.12%. When you compare this to the costs of investing in a medium- and long-term ETF, which are between 0.49% and 0.80%, you will immediately notice the benefits of BullionVault. Finally, there are also costs for the transfer to your current account.

How to log into BullionVault

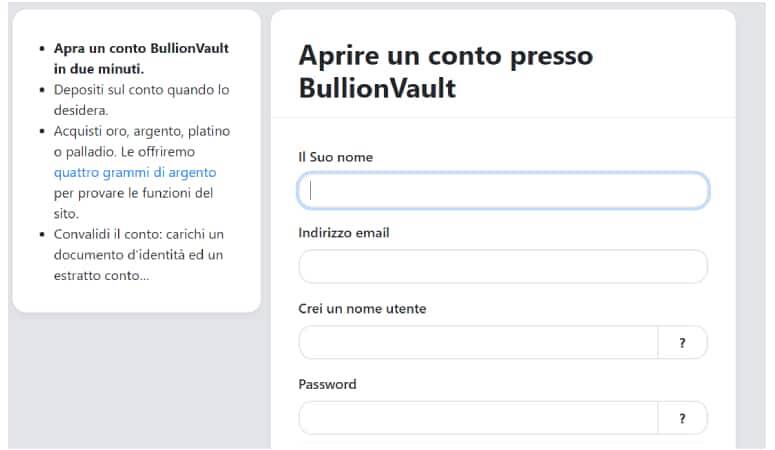

To access BullionVault you will need to register . The process takes less than ten minutes and you can already make your first gold purchase right away. You will need to access the home page of the site and click on the Open Account button .

You will be prompted to enter:

- name and surname;

- email address;

- create a username;

- generate a secure password.

At this point, you will need to answer a simple question about how you found the platform and accept the terms of the agreement . On the next screen you will be prompted to verify your identity by clicking on the link sent to your email. The process is almost over.

You will only have to confirm the willingness to open the account and access the home page. You will receive 4 grams of silver as a welcome bonus . This will give you the opportunity to start practicing with the platform.

How to deposit money on BullionVault

To purchase gold, silver or other precious metals, you need a balance in your BullionVault account . To do this, you will need to make a transfer of funds. The first step will be to validate your account. You will have the option to do this within 12 days of opening . We therefore recommend that you do it immediately, so as not to find yourself with the blocked account. For this, you just need to access the settings section and enter Personal information . There will be some items to fill in and you will be asked to insert a copy of a valid identity document.

You will now have maximum freedom to make the first transfer. The platform does not accept bank checks or over the counter payments. It will not be possible to send money via PayPal or using a Postepay . For security purposes and to have maximum transparency on all the money transferred to the platform, you can only make a bank transfer .

Here are the steps to follow:

- usa le coordinate bancarie on BullionVault;

- make a transfer;

- wait for the credit;

- carries out the sale.

BullionVault has an English bank IBAN . This means that the times for crediting a wire transfer are those of London. Furthermore, it is important to insert your username in the purpose of the transfer, to obtain the credit. The times vary between 24 and 48 hours.

The minimum payment amount is € 100, with a maximum amount of € 8 million. Once you have availability on your balance, you can move on to the next step: buying the precious metal.

BullionVault review: how to buy gold, silver and platinum

At this point in our BullionVault review, let's see how to buy precious metals independently. The ones you will buy are investment bars . The weight is established by the LBMA in order to maintain a certain value.

The platform allows you to carry out the purchase operation in different ways:

- trading at market price;

- peer to peer purchase on the marketplace;

- automatic gold investment.

1) Buying and selling at the daily price

You will have maximum freedom to invest in gold, silver and platinum at the Fixing price . This term indicates the price that is established in London every working day through an auction in which the main world banks participate and which takes place at 3.00 pm.

The set price is made public every evening at midnight, indicating the daily value of gold, silver, palladium and platinum. Given the change in the quotation that occurs at 3.00 pm, you will have a well-defined time period to place your order. This varies based on the type of precious metal you want to invest in.

Here are the times based on the time zone of Italy:

- gold: by 2.35pm;

- silver: by 11.40am;

- palladium and platinum: maximum for 13.45.

After that date, orders will not be accepted and will be executed the next day. You must consider that you will have the purchased metal available within a maximum of 48 hours. You will be able to check the number of bars bought in the section of your balance.

2) BullionVault Review: Peer to Peer Buying

Another option is to buy gold, silver or platinum directly from another registered user on the BullionVault platform. This is useful if you are familiar with the market. Let's see how to proceed. First, you will need to access the order panel section .

Here you will find applications and offers for different quantities of precious metals. With one click you can select what to buy and validate the operation. In this case, gold prices vary from the quotation provided by the LBMA, since each user can set his own sales quota.

3) Automatic investment plan

Do you want to buy gold on the BullionVault platform, but have no experience in the markets? Do not worry. The site offers you the possibility to make a periodic investment automatically . It will be the platform that will convert the money you invest into gold and go to keep it in a vault, based on some parameters you set.

To activate this option you will need to follow these steps:

- log into your BullinVault account;

- access the settings section;

- choose the Investment Plan option ;

- establish the recurring amount to invest;

- activate the service.

To simplify the procedure, you can instruct your bank to make a periodic transfer . At any time you can suspend the investment plan and convert your gold into cash or keep it safe in the vault.

BullionVault Review: Vaulted Rooms

In the BullionVault review we mentioned the word vault several times . This term identifies a physical place where the gold, silver, palladium and platinum you have purchased will be kept.

In fact, BullionVault has signed an agreement with three private companies specializing in the transport and storage of precious metals. All three are licensed to offer these services by the LBMA association.

Here is who the platform leans on:

- Loomis International;

- Malca-Amit;

- Brink’s.

The first work on the American continent, Europe and Asia, and deposits the gold in Zurich. Malca - Amit is headquartered in Hong Kong, while Brink's company is in Virginia and operates throughout the United States. Depending on the type of metal you buy and the country of residence, your gold will be deposited in one of these vaults.

The vault chosen is identifiable in the section of your balance. The BullionVault platform gives you maximum transparency on vault rooms. In fact, you will have a daily report of those in which your gold has been deposited, in which there is a list of all the bars. No one will be able to make a withdrawal except from your desk and by entering your password. This makes unauthorized theft of the precious metals you own impossible.

How to sell gold, platinum and silver

The process of selling gold is very similar to that of buying. Once you have completed the operation you will have to wait for the money to be credited to your account. It can take anywhere from a few hours to a maximum of two days.

At this point you can choose what to do, that is if:

- invest in other metal;

- withdraw money.

In this second case you will have maximum freedom to dispose of your money . The operation can take place only and exclusively using the bank account for payments. To proceed, you will need to access your balance and click on the Withdraw item .

You will be asked to verify the IBAN on which the transfer will be made. The next step is to enter the amount you want to withdraw and confirm the operation through the security code in your possession.

The money will arrive within 48 hours. You must always refer to London time when you do this. Furthermore, based on the amount, a commission ranging from € 20 to € 30 will be applied.

Finally, you will have the possibility to transfer the money to one of the best online banks or to a traditional one, regardless of where it is located. The only thing to consider is that the account must be in your name only .

BullionVault review: opinions

Is it worth investing in physical gold and precious metals through BullionVault? To answer this question it may be useful to evaluate what are the pros and cons of this platform. First, registering and using the site requires little knowledge of the market. The interface is all in Italian, which greatly simplifies transparency and operations. In addition, you will have the real-time graph of the price in gold and other metals, as well as the ability to trade at the market price or from another user.

Another aspect to consider are the costs. Users agree that BullionVault is an affordable site , as there is no monthly fee, only operating fees apply. Instead, a separate discussion concerns the cost of custody and insurance of physical gold in vaulted rooms.

Even this, when compared to other types of investment, is competitive. Finally, you will have maximum security for your money. In fact, the site is recognized to operate by the most important body for the trading of precious metals, the London Bullion Market Association (LBMA), as well as providing you with maximum transparency to verify the possession of your bars.

Posting Komentar untuk "BullionVault review: how the platform to buy gold, silver and platinum works"