Inditex, Rovi and Viscofan, among the values that will best deal with rate hikes

The rises in interest rates, which are already being felt in the Euribor, are also going to affect companies. Those listed companies with the most debt, and with bonds more referenced to variable rates, will be the ones that are going to see their financial bill increase the most.

On the other hand, Spanish stocks such as Inditex, Rovi or Viscofan, or American giants such as Alphabet (Google's parent company) or Microsoft, face this scenario with much greater calm. The fact of having very little debt and having positive cash flows means that rate hikes will barely affect them.

It is clear that their accounts are not immune to a slowdown in consumption or the threat of an imminent recession, but not having the weight of a heavy debt on them means that their managers have more flexibility to be able to react to the new scenario.

Managers from various investment firms select a dozen quality securities, with very healthy balance sheets and potential for revaluation.

1. Inditex: a company with a solid balance sheet and no financial debt

The clothing manufacturer is a favorite stock for managers looking for quality, low-leverage stocks. Emilio Ortíz, director of investments at Mutuactivos, highlights that Inditex "has a very competitive business model at a global level, a very solid balance sheet, without financial debt, and a very consolidated management team". At the prices at which it is now trading, "it seems to us a good investment with a view to the medium-long term," Ortiz defends. The entity is now trading at 21 euros, close to the eight-year low it hit at the start of the Ukraine war, when it announced the closure of its 500 stores in Russia. Javier Galán, investment director at Renta 4, also has Inditex as one of the largest positions in his portfolio.

2. Rovi: excessive corrections in a security with a positive net cash position

The pharmaceutical company is especially appreciated by the managers of the Finaccess firm. Lola Jaquotot explains that this security will not have any kind of penalty for rate hikes "because it has a positive net cash position" and she believes it is a great investment opportunity. The manager recalls that the value has fallen by more than 40% this year. "We believe that this penalty is explained because the market has excessively linked its evolution to that of Moderna, with whom it has an agreement, but ignoring the rest of Rovi's businesses," reflects Jaquotot. The company is trading at 14 times profit, “which seems to us a very cheap price to buy”.

In addition, the expert emphasizes that in the coming months it could give very good news with drugs such as Risperidone (an antipsychotic) and Letrozole (an anticancer).

3. Logista: very stable margins and almost monopolistic business

Logista is one of the companies that is best prepared to protect its margins against rising inflation and oil prices. A large part of its contracts with tobacco or pharmaceutical companies are indexed to the CPI, which allows them to transfer the increase in the price of fuel, although with a certain time lag, normally monthly or quarterly. Alfonso de Gregorio, manager at Finacces Value, recalls that Logista "operates with very stable margins of 24-25%" which, moreover, "are highly protected by the high barriers to entry that the business has, where Logista is almost a monopoly" . On the other hand, the company has a very solid balance sheet, with a great cash generation capacity. Although it has had a good year on the stock market, it is still trading far from the highs reached in 2017.

4. TotalEnergies: an estimated leverage of almost zero

Oil and electricity companies resist between the preferences of investors for their dividend yield and for the business opportunity that the energy transition represents. In the case of the French company TotalEnergies, also because of the quality of its balance sheet. As explained by Juan José Fernández-Figares, director of analysis at Link Securities, "its level of indebtedness is very low, presenting a net debt to estimated EBITDA ratio for 2023 of almost zero".

It also highlights that the company is currently trading at a very low PER, of 3.8 times estimated for 2023, and that the forecast for that year of its free cash flow performance is greater than 20%. "It offers a very attractive dividend yield, significantly higher than 6%," he adds. So far this year, TotalEnergies shares are saved from the burn and are up almost 8%.

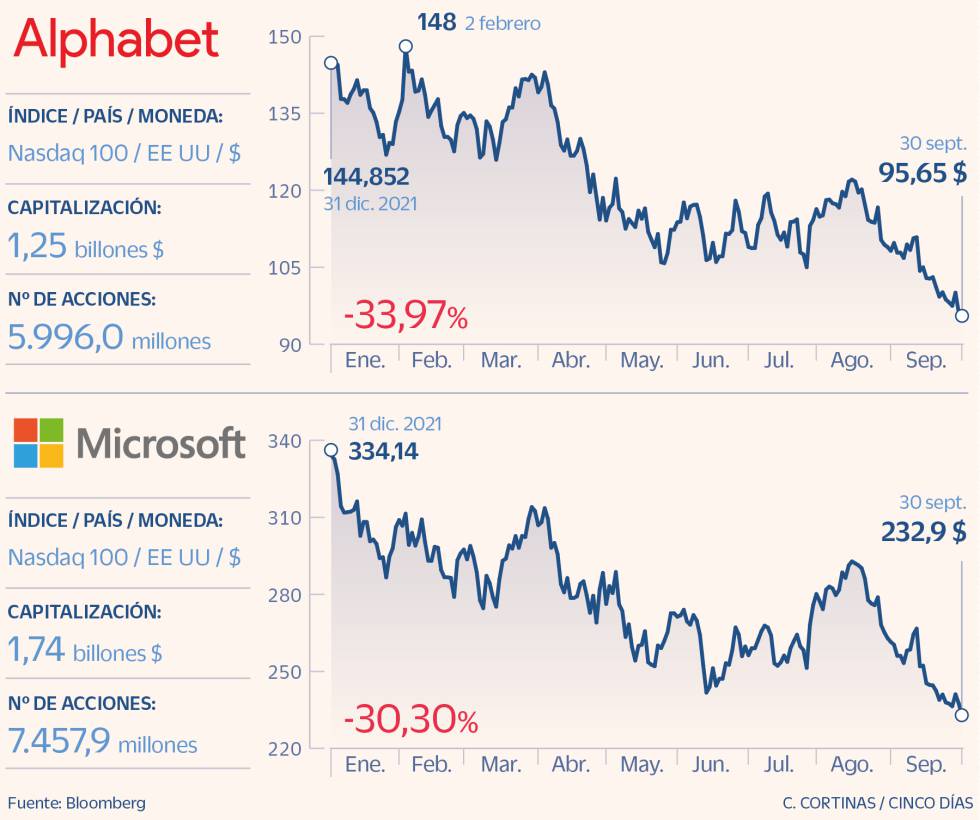

5. Alphabet: rates that impact valuation but not debt

The parent company of Google shares with the rest of the technology giants in the US the fact that it hardly has any net debt. The rate hike is affecting its price not because of the impact on indebtedness but because of its effect on valuation, since it requires discounting future cash flows with a higher price of money.

Second quarter results were lower than expected, although advertising revenue was not. Group sales reached 69,690 million dollars and EBIT, 19,453 million, while free cash flow at the end of June was 12,594 million.

So far this year, shares are down more than 30%. Citi is one of the firms that insists on buying, an advice that it reiterates after the presentation of the new functions of Google Maps.

6. Microsoft: 90% of analysts who follow the value recommend buying

The big technology companies in the United States have a very healthy financial situation. Javier Galán, director of investments at Renta 4, points out that companies like Microsoft have significant appeal. "As they have no net debt, they will be able to see the crisis of the rise in interest rates from afar," says the manager.

The prestigious German firm Flossbach von Storch has also selected Microsoft as one of its favorite companies for its Global Quality investment fund.

The market consensus is also very favorable regarding the value's potential. Of the 58 analysts who follow its evolution, 52 recommend increasing exposure to it. And none choose to sell. The revaluation potential that they grant after the last corrections is 39%.

7. Stellantis: a net box of more than 25,000 million

Optimum balance sheet management allows Stellantis to face interest rate hikes with a net cash balance of more than 25,000 million euros. The company is suffering the punishment common to cyclical stocks and has been hampered by the lack of some components, mainly chips, which is common in the automotive sector. But according to Juan Fernández-Figares, it is trading at a few knockdown multiples. At an estimated PER for 2023 of 2.7 times and a dividend yield of 10%. “In addition, their ability to generate free cash is very high, with an estimated free cash flow return for 2023 close to 20%,” he explains.

The value entails the risk of a downward revision in the results due to the economic deterioration although, even so, “the company would continue to trade at attractive multiples”, according to Fernández-Figares.

8. Viscofan: packaging that resists the onslaught of inflation

For Javier Galán, director of investments at Renta 4, Viscofan "is one of the Spanish companies that is not going to be affected by the rise in financial expenses." In the first half of the year, the company already presented results with record sales of 568 million euros, thanks to the increase in business and, in large part, also to the ability to pass on the rise in inflation to the final customer with price increases. The Navarran food packaging company is, along with Ence, the favorite Spanish value for Berenberg. The market consensus has 93% buy advice for Viscofan and none for sale.

The shares of the company, which will present results on October 20, have lost almost 2% so far this year and have risen 13% since the annual lows in May.

9. ASML: very powerful technology with low leverage

The Dutch manufacturer of components for the semiconductor industry is one of the favorite values for the Bolsa de Renta 4 team. "It is a company that has a very low level of indebtedness," says Javier Galán, director of investments at Bolsa de Renta 4. manager.

ASML has become the undisputed leader in extreme ultraviolet lithography (UVE), one of the most precise techniques for priming ever smaller microchips.

Christopher Gannatti, head of analysis at WisdomTree, recalls that since it is such a strategic industry, the United States and the Netherlands signed an agreement not to buy UVE machines in China.

From the prestigious Spanish manager Bestinver they have been increasing their exposure to ASML in recent months.

10. Fairfax Financial: The benefit of rising rates on insurers

Fairfax Financial is a Canadian group that has insurance and asset management businesses. The firm is one of the favorites of Emérito Quintana, adviser to the Numantia Patrimonio fund. “The rise in rates is going to benefit them a lot because they have 36,000 million dollars of very short duration fixed income in their portfolio, so the value of their bonds is falling much less than the rest when interest rates rise, and with the maturities of each bond can reinvest at higher interest rates and increase their income," says Quintana

At the end of 2021, some 530 million were entering annually from interest, coupons and dividends. As they have been reinvesting at higher rates, at the end of June this rate of income had risen to 950 million per year, and at the end of September it will be even higher.

Posting Komentar untuk "Inditex, Rovi and Viscofan, among the values that will best deal with rate hikes"