FIBONACCI TRADING STRATEGY : Price Projection For You Profitable Trade

Buy shares? Easy.

Selling shares? Easy.

Precisely saving it is difficult, especially when you are bullish.

If the stock is rallying, we must often wonder: 'How much can this share price go up?'

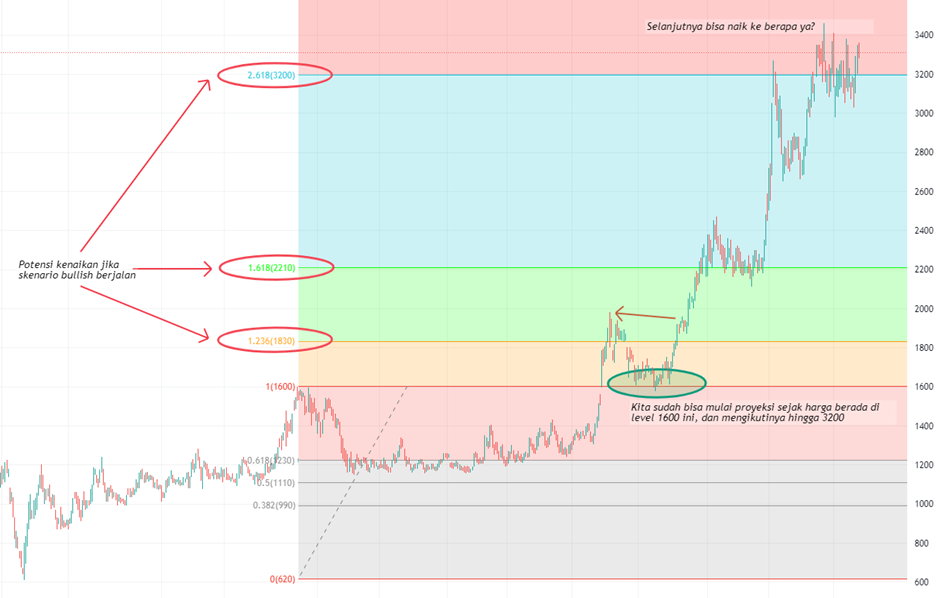

Sometimes we ask friends, ask brokers, ask stock groups, and read - read the news. But the numbers that come out can be different , no one even knows and we are not sure: 'Which one is correct? Can I still buy/hold?' sometimes we end up just looking at the previous high and using that level to sell ( red arrow ).

Eh, but after we sold it, the price could just keep going up and we already ' lost things '. If you continue to do this ( sell at the previous high ), when will I be able to make big profits keeping uptrend stocks?

Things like the picture above often happen. Buying the shares is correct, the buying level is already below, but the weakness is that we are selling too fast ( and the price is still up 70% too! ).

We can avoid this confusion if we have a method for calculating the target price. The target price is not only for rising targets, but also for falling targets. This is not a retracement down target, but a strong bearish target price.

We can calculate the potential target for an increase, you know, including: scenarios for an increase , the most likely peak to be reached, to the extended target price from a simple analysis. Let's try to use Fibonacci Retracement but this time we use it to calculate the rally target.

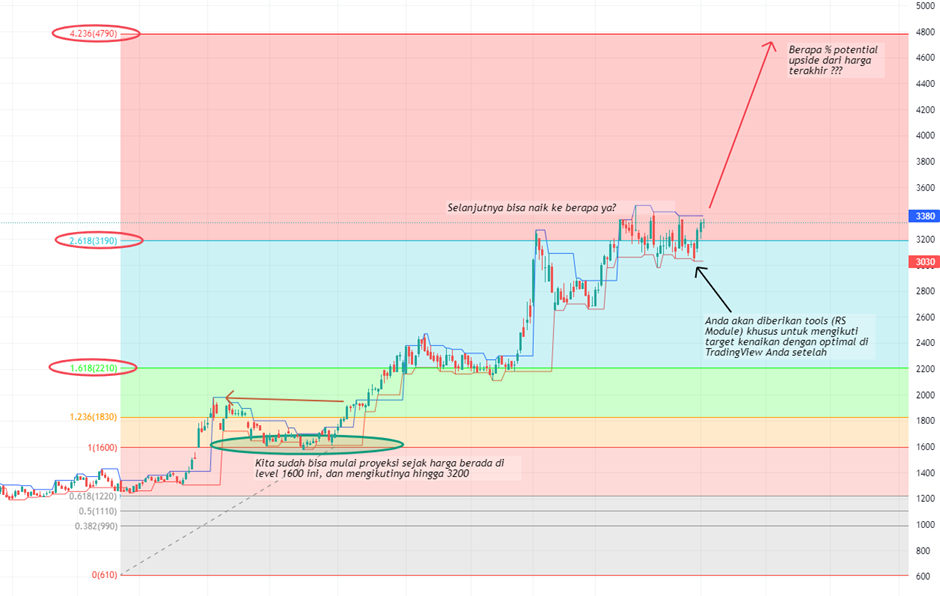

By mastering the price targeting method, which is combined with Fibonacci + Price Patterns , then we as traders have a clear scenario to follow the target of rising stock prices. As the image above shows, from the price of 1600 we already have targets for further increases.

And the next question, is there still potential for more increases?

Come on, join our class and learn the right Fibonacci method for maximum results!

Price targeting is the right way to calculate the potential increase or decrease in stock prices.

It's time to leave the common mistake of rushing into buying and selling stocks. By understanding price targeting, you can know how to set increase and decrease targets to make it comfortable to buy and hold stocks.

The ability to calculate an increase target will be a benefit for traders in taking positions and calculating the risk and reward of monitored stocks.

What will you learn:

- Get to know the pattern of stock price movements before being bullish or bearish.

- Understanding important support and resistance in price movement patterns, along with the market psychology behind them.

- Using a systematic approach in calculating the target price.

- Calculating an advanced target price, especially for stocks that break all time highs.

- Calculating the stock's downside target to wait for a lower buy area.

Posting Komentar untuk "FIBONACCI TRADING STRATEGY : Price Projection For You Profitable Trade"