Investing in diamonds: is it worth it today?

Is it worth investing in diamonds? This is a question you may have asked yourself given that, due to Covid-19 and the increase in the inflation rate, the luxury sector has lost more than 22%. However, in this sector there is a counter-trend reality: the diamond market .

After the collapse of production in 2020, 2021 is expected with new historical records and constant growth, returning to pre-pandemic levels, also confirmed for the new year. Data that led traders and investors to place interest on precious stones, valued as safe haven assets like gold.

This sector today can be considered a valid alternative to invest money and earn without risking , even in a phase of economic crisis. In this context, it becomes essential to know how the diamond market works and what their price is today, as well as the opportunities to buy and invest in them. Here's what to know.

Why invest in diamonds today

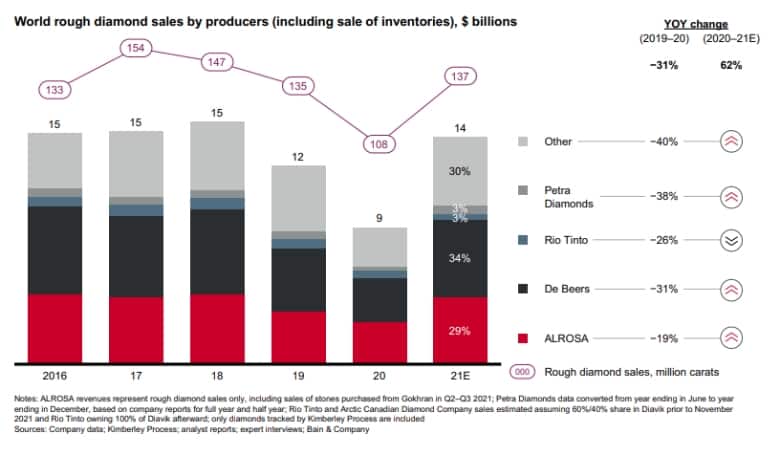

An environment that does not look promising for investing. However, in the case of diamonds, the trend is positive . As indicated by the Global Diamond Industry report 2021-2022 , a report released by Bain & Company, 2020 ended with an all-time low in production.

108 billion dollars have been reached with a -11% compared to 2019, a year which in turn saw a loss of 9% of the historical share reached in 2018, equal to 147 billion dollars of stones.

The trend in 2021 is different. The year started slowly, but soon the production figures changed with growth across all sectors:

- rough diamond production: + 62%;

- cutting and polishing: + 55%;

- sales of diamonds and jewels: + 29%.

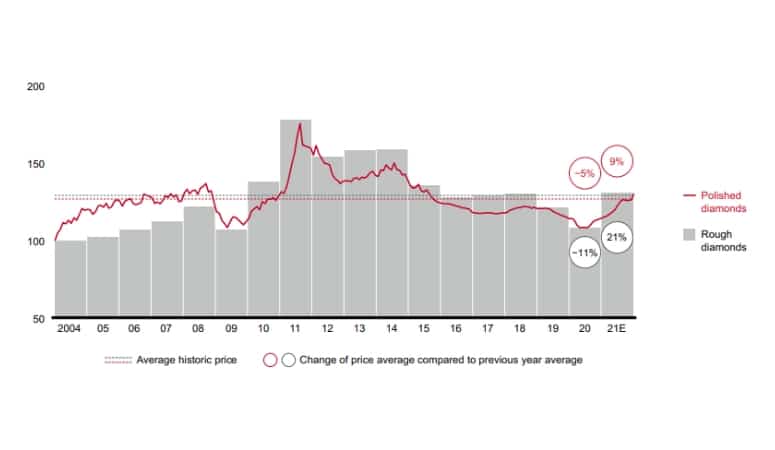

If you report this data to the previous year, there was an increase in the individual sectors, respectively by 13%, 16% and 11%. Diamond production also increased, reaching $ 127 billion.

If you compare the data of the last 5 years, the average growth of precious stones is equal to 5% . These data show that the diamond market can be a viable alternative to buying gold if you are looking for an anti-inflation asset . Let's see why.

Investing in diamonds or gold?

What is worth more, gold or diamonds? It is a question that you may have asked yourself several times. They are two limited goods on earth and as such have a value that tends to grow over time.

Today an ounce of gold is worth about € 1,789.7. In the case of diamonds, the price varies based on several factors. In general, 1 carat starts from a minimum of € 20 and reaches a maximum of € 8,000.

If you compare the yield curve between gold and diamonds, the precious metal has achieved an average growth of 2.5% over the last 5 years . In the case of diamonds this, today, stands at 5% per annum .

Furthermore, the gold market has suffered somewhat from stock market uncertainty. Just consider that, after reaching € 2,000, today it is below this resistance.

On the contrary, the diamond market does not seem to be affected by the crisis phase . Of course, during the lockdown there was a contraction in production, which in 2020 fell to only 111 million carats per year.

Furthermore, the limitations related to the health emergency have had a significant impact on the sector, even if it was the sales sector and not the production sector that were mostly affected .

Indeed, the price of diamonds has increased again both for investment and for the second-hand sector, with an increase of 21%. In fact, compared to gold, the price of precious stones is linked to a single list, the Rapaport Diamond Report , which establishes their price.

How to invest in diamonds today

What to evaluate when it is best to invest in diamonds? The price of diamonds varies based on a series of factors that affect the final price of a stone.

For example, as in the case of 18k gold , which will have a different value than 24K, in diamonds the situation is similar, although more complex.

In fact, you can have two identical gems of weight or shape, but with a different price. To invest in diamonds safely it will therefore be essential to consider the following factors:

- type of diamonds;

- quotation of diamonds;

- choose how to invest in diamonds.

Investing in diamonds: the type

Today there are different types of diamonds , but they can be grouped into two categories:

- investment diamonds;

- used.

If you want to obtain a possible future income by purchasing precious stones, you will have to refer to what are called investment diamonds or even blister diamonds .

Their main characteristic is that they are available in standard carats, made in order to have a specific price. In this way you will have the possibility to monetize a diamond in a short time, by selling it, or by buying a certain number of stones if you want to strengthen your position.

The diamonds used are instead those obtained from objects, or present in jewels. They will have a variable weight. This also applies to their cut and shapes, since the stone will be adapted to the object it is to enrich.

How much makes investing in diamonds: the listing

Another aspect to consider is how the price of a diamond is determined . A system that is quite recent, since it was born in the late 1800s. In fact, in 1830 the unit of measurement of carats, corresponding to 0.20 grams, was introduced, in addition to the creation of a system that would allow to identify the price of a diamond in a precise way.

This idea was developed a few years later by a gemologist from the GIA (Gemological Institute of America) creating the Rapaport Diamond Report . It is a document on the basis of which, every week, by the Antwerp Diamond Bank, the price of each precious stone is established in relation to a series of characteristics.

Characteristics of diamonds

If you want to find out what all the parameters used to define the price of diamonds are, we invite you to read our complete guide on the quotation of diamonds. Below we analyze some factors such as those defined by the 4 Cs:

- carat (carat);

- colore (color);

- cut (cut);

- purity (clarity).

The carat is the unit of measurement created in 1830 and which corresponds to 0.20 grams. It is used to indicate the weight of a diamond and consequently its relative size. Generally speaking, the higher the number of carats, the greater the value of a stone should be. However, the price will also increase due to other factors.

In particular, the lighting effect is considered. This leads to the second parameter indicated: the color of the stone . The diamonds that have a higher value are those that are colorless, or those with a slight yellowish tinge. On the other hand, the less expensive ones have a brightness tending to bluish and green and, in some cases, to black.

Two other factors that affect the price are the cut and the purity . The first term considers the intervention of man in giving shape to a specific stone and then transforming it from rough to a polished diamond. In the second case, you have to evaluate if there are any imperfections inside.

Where investment diamonds are bought

How to safely buy an investment diamond ? Today, you can buy precious stones in three ways:

- physical purchase;

- banks;

- directly online.

In the first case, you can contact a Buy Gold shop or a jeweler specializing in the sale of diamonds. In addition, you will have the option to use one of the best investment banks as well .

The purchase of physical diamonds is not easy, even if thanks to the web you can do it directly from your computer and keeping the diamonds in safe caveaux offered by the individual platforms.

This is due to the numerous parameters that you will have to evaluate. To facilitate this operation, investment diamonds include documents called certifications . These are issued by the most important gemological institutes in the world such as:

- High Council of Diamonds of Antwerp (HRD);

- Gemological Institute of America (G.I.A.);

- International Gemological Institute di Anversa (I.G.I.);

- Gemological Education Certification Institute (G.E.C.I.).

Within this document you will find all the information to identify its characteristics. Here are the main ones:

- type of diamond;

- number of carats;

- cut;

- presence of imperfections;

- indication of the color of the diamond;

- brilliance;

- fluorescence;

- origin;

- value of the stone.

How much does an investment diamond cost today?

| Color | Purity | Ct 0,30-0,29 | Ct 0,40-0,49 | Ct 0,50-0,59 | Ct 0,70-0,89 | Ct 0,90-0,99 |

| D | IF | 5,950€ | 7,140€ | 11,000 | 14,570€ | 21,250€ |

| D | VVS1 | 4,610€ | 5,650€ | 8,620 | 11,300€ | 18,730€ |

| AND | IF | 4,610€ | 5800€ | 8,470€ | 11,300€ | 18,730€ |

| AND | VVS1 | 4,310€ | 5,350€ | 7,880€ | 10,560€ | 17,240€ |

| F | IF | 4,460€ | 5,350€ | 7,430€ | 10,410€ | 17,090€ |

| F | VVS1 | 4,170€ | 5,060€ | 7,140€ | 9,810€ | 15,460€ |

| G | IF | 4,170€ | 4.910€ | 6,840€ | 9,370€ | 15,460€ |

| G | VVS1 | 3,870€ | 4,610€ | 6,540€ | 8,770€ | 12,930€ |

| H | IF | 3,870€ | 4,460€ | 6,390€ | 8,470€ | 12,930€ |

| H | VVS1 | 3,720€ | 4,310€ | 6,250€ | 8,470€ | 11,740€ |

Thanks to the certification, it is possible to have a basic indication of the value of the investment stones in blister packs. We went to consider the most used cuts, taking as reference the GIA color scale , and in particular the interval from the letter D to that H, and that of purity. Obviously from this letter onwards, the price will go down drastically.

How to invest in diamonds with online trading

You can invest in diamonds online today even without buying the physical product directly, but operating with one of the best trading platforms .

You will have a double opportunity:

- buy shares related to diamond companies;

- invest in commodity ETFs.

In the first case, you will be able to operate directly on mining companies specialized in the extraction of precious stones. For example, among the interesting stocks for 2022 , you can consider those of Petra Diamonds Ltd. A mining company listed on the British market, with a price that today has a value of 50% compared to the previous year.

The other opportunity is to trade on the best ETFs . Exchange Traded Funds are index-linked investment funds. This means that their performance will reflect that of an underlying asset. Furthermore, as funds, the price will be established based on the total prices of each individual asset.

This offers you steady growth and the ability to reduce risk with low volatility. In the case of diamond ETFs , they are made up of companies that work directly or indirectly with gemstones.

The types of brokers that allow you to invest in diamonds safely offer you all the tools you need to operate both if you have a knowledge of the market and if you are a beginner.

For example, you will have a demo account , which is a simulated system through which you can reproduce the market trend, but using virtual money. This allows you to start learning how the platform works, as well as work out your trading strategy without losing real money.

Is it worth investing in diamonds today? pros and cons

Today investing in diamonds is considered a valid alternative to other commodities, such as silver , platinum, palladium and of course gold.

In fact, for 2022 an increase in the production of precious stones is expected to reach 116 million carats, with a value of over 134 billion dollars and a growth of 20% compared to the pre-Covid-19 phase.

For 2023-2024, the forecasts for the diamond market are optimistic, with an even greater increase for the entire sector. For some analysts it will reach the historical record of 2018.

Furthermore, the sector proved to be solid, thanks to the presence of certain rules that define the listing and to a more limited use of precious stones than gold. Even today, the diamond market remains connected to a few large companies , a factor that has allowed to stabilize the price and, above all, to keep the yield high over the years.

However, you must consider that investing in diamonds is an operation that is part of a medium and long-term strategy . This involves allocating a certain amount of liquidity from your portfolio, compared to investing in other assets such as cryptocurrencies or stocks.

Finally, even if the sale has been simplified, thanks to the presence of online platforms, you must remember that the operation still requires a certain knowledge of the parameters indicated by the Rapaport Diamond Report and, above all, requires longer times than gold. In this perspective, a useful piece of advice is to keep yourself up to date on the subject and to rely only on experts in the sector .

Posting Komentar untuk "Investing in diamonds: is it worth it today?"