Is investing with Fineco worthwhile? How it works, costs and opinions

If you are looking for one of the best trading platforms or a bank to operate on the stock exchange , you can consider investing with Fineco . An institution in which both of these elements are combined.

Founded in 1996 with the idea of giving each customer maximum freedom to access their online current accounts, since 1999 it has developed a reliable, powerful and functional trading platform to operate on the market.

Today with Fineco you can access the main world markets, including the American one, investing from stocks to ETFs, from CFDs to cryptocurrencies . The combination of professional and at the same time intuitive tools has led retail and professional traders to express several positive reviews.

You will find out, by reading our article, if it can be considered a suitable platform for your investments and what are the possible alternatives.

Invest with Fineco

| Typology in assets | Specific |

| Actions | 2,000 European, Italian and US market shares |

| CFD | Cryptocurrencies, commodities, indices, currencies, stocks |

| ETF | More than 4,000 investment funds |

| Cryptocurrencies | Bitcoin ed Ethereum |

| Bonds | More than 6,000 assets |

| Options, Futures, Certificates | On indices and stocks in the USA, Europe and Italy |

Investing with Fineco Bank is an operation accessible to all types of traders. In fact, you can choose to use this platform both if you are approaching the world of trading for the first time, or if, on the other hand, you have a complete knowledge of financial instruments and want to have a single financial instrument in which you can:

- manage your expenses through a current account and payment cards;

- have a trading platform to operate in full autonomy.

If you want to learn more about banking services, we refer you to our complete review on Fineco Bank . Below we will focus on how to invest using the online trading platform.

Investing in Fineco reviews

Is it worth investing with Fineco ? In this regard, we went to analyze what are the reviews on the trading service. In fact, if the current account is considered among the best in Italy, thanks to a high cost-to-service ratio, the competition for what concerns the trading platforms is really high.

The version created by Fineco is called Powerdesk and is a webtrader interface. It has been developed in over 20 years of continuous updates , proving today to be a valid system both for inexperienced traders and for those who have a high knowledge of the market.

In addition, it has received several positive opinions as it is an ever-evolving system . For example, today you can also operate on cryptocurrencies such as Bitcoin and Futures with competitive costs.

Among the main comments on investing through Fineco are those regarding security , given that there are latest generation encryption systems and the protection of your data, as well as the solidity of the Fineco Group. Finally, the service cost ratio is medium-high.

With Fineco you can combine a flexible and innovative online bank account with a trading platform considered among the best, all while having a single account .

Investing with Fineco: costs

| Type of costs | Specific |

| Costs linked to the platform | Current account, trading platform, custody costs |

| Operation | Commissions and spreads on assets |

| Promotions and offers | Any discounts or cost reductions in the presence of particular requirements |

What are the expected costs of operating with Fineco? You have to distinguish between:

- costs related to the platform:

- operating costs:

- any promotions and specific offers:

The Fineco account has a monthly cost of € 6.95 , with a maximum of € 83.4 per year. This expense allows you to access all the services and activate the Fineco Trading platform which does not require a monthly fee. Furthermore, there are no securities custody fees, or a penalty for inactivity of the platform.

You will only have to deal with what are termed operating costs . You must consider that in some cases a commission will be applied, in others the spread. Let's clarify these two concepts:

- commission: it is an amount added every time you make a purchase or sale transaction and will scale according to the number of operations you will carry out;

- spread: is the difference between the buy and sell market price and the one entered on the platform. It is calculated in points (PIP).

Let's see what are the operating costs of the various assets.

Costs of shares and ETFs with Fineco

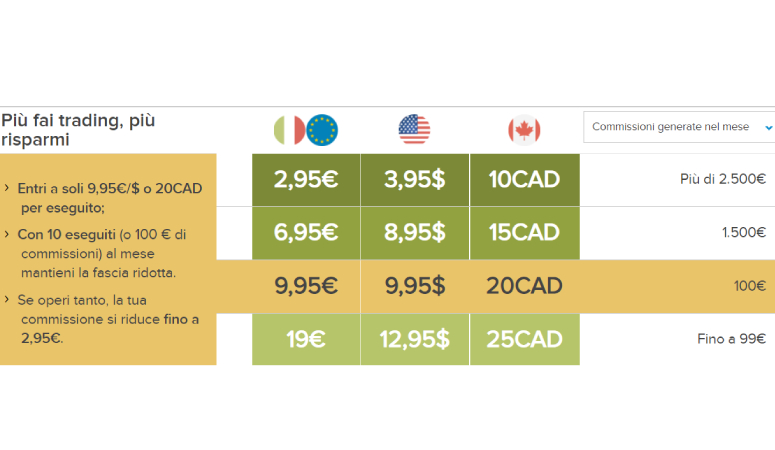

The basic commission for operations on shares, ETFs and certificates is € 19. A value that can be reduced to a minimum of € 2.95 if you increase the volume of operations.

In fact, if you operate occasionally, generating monthly commissions below € 100, the cost will remain unchanged at the quota:

- € 19 for operations on the Italian and European market;

- $ 12.95 or CAD $ 25 for North American squares.

On the other hand, if you operate with a certain diligence and carry out a minimum of 10 transactions per month , exceeding € 100 in amount, the value of the commissions will drop to € 9.95.

Finally, if you are an experienced trader, making more than € 2,500 per month of operations, the costs are:

- € 2.95 for operations in Italy and Europe;

- € 3.95 in the American market.

CFD trading costs

| CFD | PIP |

| Indices | And 0.02 at 6 |

| Raw material | And 0,2 and 2,9 |

| Actions | And 0.02 at 5 |

| Cryptocurrencies | And 0.3 at 7 |

| Forex | 1 PIP |

Among the strengths that have led many users to express positive reviews on Fineco, there are the costs for operations on contracts for difference. There are no trading fees, but a spread will apply .

This varies based on the type of asset you are going to trade on. In fact, it will be a value that will be added to the purchase or sale price of the stock. For example, imagine you buy 100 Twitter shares at a price of $ 41.39.

You will see this value on the platform:

- purchase price: 41.56 (value + spread);

- selling price: 41.41 (quotation + spread).

When you close the transaction, you will have the price net of expenses, in this way you will know exactly the real value of your assets.

Expenses on futures and options

In the case of futures, options and derivatives , the fee will change based on two factors:

- type of market you invest in;

- minimum lot amount.

For example, if you decide to buy a future on the FTSE MIB index , with an amount less than € 500, you will pay a commission of € 6.85. On the other hand, if you decide to open an option on the NASDAQ , the cost will range from $ 3.95, for trades up to $ 499, to $ 1.95, if you exceed $ 1,500 monthly.

Fineco specific promotions and offers

The last aspect to consider when investing with Fineco concerns any discounts or promotions . For example, Fineco Bank is considered among the best accounts for young people , as if you are under the age of 30, you will have access to a reduction on trading and account opening fees as well as other benefits.

It includes:

- current account fee zeroed up to 30 years;

- operating fees of € 2.95;

- zero currency conversion fees;

- free costs on ETFs and PACs.

How to invest with Fineco Bank

To start investing with Fineco Bank, you will need to follow these steps:

- open a Fineco Bank account;

- registrars to Fineco trading;

- choose the type of investment.

The first step is to open a Fineco current account , a procedure that you can do online, using the official home page , or by downloading the handy app. You will need to enter your personal data and a password, confirming your identity through the appropriate link sent to your e-mail and mobile phone. Now you will have to decide if you want a single or joint account .

The next step is to enter personal data, including those of any joint holder and carry out an identity verification through the following two steps:

- photo of your double-sided document;

- video-sefie.

The last step is to accept the terms of the contract and wait for the approval of the account opening: this will arrive by e-mail. At this point, you can start investing in the stock market, by accessing the various services and activating the one on the Fineco Trading platform.

Your capital is at risk

Invest in the stock market with Fineco

The term Fineco Trading identifies the section created within the current account of the same name in which you can invest your money in more than 20,000 assets.

You will have an independent securities portfolio , but which relies on the main current account. This means that, through it, you can make liquidity payments on your trading platform or withdraw the money obtained from your operations.

To access the interface you simply need to select the Fineco Trading item . At this point you will be asked some questions to test your level of knowledge of the market and the type of trader you are, between retail or professional .

Once the initial phase is complete, you will have access to the Powerdesk platform , with an impressive number of tools, such as:

- real-time graphics;

- quotations of individual assets;

- news updates;

- risk management tools;

- analysis systems;

- favorites list;

- ability to customize settings.

With Fineco you have over 20,000 assets to invest in and one of the fastest and most powerful platforms in Italy, called Powerdesk.

If you want to know all the potential of this platform, read our guide on Fineco Trading .

Here we will focus on investment methods . Here's what you can do:

- cryptocurrencies;

- ETF:

- actions;

- trading CFD.

1) Invest in Bitcoin with Fineco

In recent months there has been a real collapse of Bitcoin that has dragged the entire sector of digital currencies. You can invest in cryptocurrencies with Fineco by having adequate financial instruments to deal with extreme volatility and sudden changes in direction.

In fact, you will have the opportunity to operate through:

- CFD Bitcoin;

- Knock out option;

- ETP.

CFD trading on cryptocurrencies and Bitcoins allows you to invest reduced capital and to operate in any phase of the market. In fact, you will have a leverage effect equal to 2: 1 and you can thus double the value you have invested.

Furthermore, contracts for difference are useful, but highly risky, since the same leverage effect applies to any losses. For this Fineco offers you an additional service, Fineco educational , through which you can learn how these tools work and avoid errors, as well as the presence of a risk management system with automatic orders such as stop loss and take profit .

Another opportunity to invest in cryptocurrencies with Fineco is that of knock out options . They are financial instruments belonging to the category of options, through which you can give another person the right to buy or sell a certain amount of Bitcoin, at a set time.

Finally, you will be able to use ETPs . This acronym identifies Exchange Traded Products, indexed investment funds that include:

- ETF: Exchange Traded Funds sulle criptovalute;

- ETN: Exchange Traded Notes;

- ETC: Exchange Traded Commission.

Finally, in addition to Bitcoin, you will also have the opportunity to invest in the second largest cryptocurrency: Ethereum .

2) How to invest in ETFs with Fineco

Among the investment funds that replicate the performance of an underlying asset, you can consider investing in Fineco ETFs . Their characteristic is that of being financial instruments with a price that is determined by the performance of the assets within them.

Furthermore, they provide for passive management, since they will only consist of securities inherent to the fund itself. For example, if you buy one of the best ETFs in the hi-tech sector, you will find only technological assets inside, while if you buy green ones you will have the certainty that your money will be invested only in companies that contribute to the well-being of the Planet or have adopted a self-sustainable business model.

Fineco ETFs are assets chosen by the platform's team of consultants based on a series of characteristics:

- low risk;

- high yields;

- solidity of the fund management company;

- reduced initial investment;

- sectors of interest with a high probability of growth;

- ETFs also valid for supplementing PACs (capital accumulation plans).

In the following table we have included some of the best-selling ETFs on Fineco Trading . If you want to learn more about this issue, we invite you to read our review on Fineco ETFs .

| ISIN code | Description |

| LU1681038599 | Amundi IS Nasdaq-100 UCITS ETF Daily Hedged EUR |

| LU1681038243 | Amundi IS Nasdaq-100 UCITS ETF EUR |

| LU1829218749 | Lyxor C. Refinitiv/CoreCommodity CRB TR UCITS ETF |

| LU1650491282 | Lyxor Core Euro Gov. IL Bond (DR) UCITS ETF – Acc |

| FR0007056841 | Lyxor DJ Industrial Average UCITS ETF – Dist |

| LU1650490474 | Lyxor Euro Government Bond (DR) UCITS ETF – Acc |

| LU1650487413 | Lyxor Euro Government Bond 1-3 (DR) UCITS ETF- Acc |

3) Invest in shares with Fineco

The Fineco platform has more than 2,000 shares in the main markets of Europe and the USA. You can buy stocks on the Milan Stock Exchange, from Fineco to Juventus shares, or invest in the most traded assets right now , such as Tesla and Amazon .

In addition, you will have the opportunity to access the best shares of the European markets. An example are those in the energy sector, with companies such as Iberdrola , Snam, Enel, Repsol Oil and Occidental Petroleum , which are achieving high returns due to rising inflation.

With Fineco trading you have two options to invest in shares:

- purchase of real shares;

- investing with CFDs.

In the first case, you must use an amount equivalent to the quoted value on the stock exchange. For example, if you decide to buy 1,000 CaixaBank (CABK) shares at a price of € 3.41, you will need to use an amount equal to € 3,410 . You will make a profit when the price rises, or if there are dividends.

If you're interested in a passive yield, read our analysis of which are the best dividend companies . The other opportunity is to trade CFDs.

Your capital is at risk

4) CFD trading with Fineco

The advantage of using CFDs on stocks or other assets is the possibility of investing a reduced capital and still obtaining greater financial exposure. This is possible thanks to the presence of leverage on margin : a percentage of money offered by the broker that will be added to your initial capital based on the type of financial instrument.

Let's take the example of CaixaBank shares. With CFDs and a leverage of 50%, instead of investing the full amount of € 3,410, you will have the same financial exposure with half the capital , equal to € 1,705.

Furthermore, you can invest in any phase of the market by opening a position:

- long or buy: you will make a profit if the price of an asset goes up;

- short or sell: in this case, you will realize a profit if the share price falls compared to the opening price of the contract.

The characteristics of CFDs make them useful tools to operate with Fineco also on other assets such as:

- Forex trading: you will have over 50 CFDs on the main world currencies;

- indices: you can operate on European, American and bond indices;

- commodities: you have the opportunity to invest in gold, silver, platinum and palladium futures;

- cryptocurrencies: you can operate on Bitcoin and Ethereum.

Investing in Fineco: what are the alternatives?

We close our article with an evaluation of what are the pros and cons of investing with Fineco . The trading platform has gotten numerous positive comments regarding the technology, interface and the number of assets you can have. In addition, it is highly appreciated that you invest without having to open an additional account, as is the case with the best online trading brokers .

The security of the platform is also a factor that makes the choice interesting. In fact, the Fineco Group is today among the safest banks in Italy and Europe, with a Cet1 ratio of 19.31% .

On the other hand you have to consider that the commissions are above the average of other trading sites and on certain assets, such as cryptocurrencies, you will have the possibility to operate only on Bitcoin and Ethereum.

In this perspective, today there are several brokers that can be a valid alternative to Fineco . The first example is the broker eToro , authorized to operate by Consob, CySEC and the English FCA, the main control bodies of the financial market.

Account registration is free and allows you to trade without commissions and only with a spread on all assets . To this you must add that you can buy more than 2,000 cryptocurrencies, keeping them in your wallet or trading CFDs.

Another option may be to choose the LiquidityX broker , recognized by Consob and the Hellenic Capital Market Commission. Registration is free and you will have a platform on which to invest in more than 6,000 assets both through buying and selling and through CFD trading.

Posting Komentar untuk "Is investing with Fineco worthwhile? How it works, costs and opinions"