Is it possible to buy Banca Sella shares?

Investing in Banca Sella shares could be a valid opportunity to diversify your securities portfolio. In fact, the Sella Group, founded in Biella in 1886, today ranks among the top positions of the most solid and secure banks in Italy and Europe, with a Cet1 ratio of 15.43% .

However, if you search for the stock within the FTSE MIB or the other indices at Piazza Affari, while Unicredit, Intesa Sanpaolo and Fineco Bank shares are available, you will be disappointed. As stated in 2020 by the president Maurizio Sella, in fact, the Banca Sella Group continues to have no interest in being listed on traditional stock markets.

Despite this, there are 105,263,158 Banca Sella ordinary shares for an equivalent value of 839 million euros. This often generates a bit of confusion on the possibility of buying the Banca Sella stock and trading online using the dedicated platform xTrading. You will find all the clarifications in this regard in the next lines.

Buying Banca Sella shares: is it possible?

| Type of markets | Description |

| MTA | Electronic stock market |

| AGAINST | Government bonds and bonds |

| THE SAME | Government bond market |

| AIM Italy | Small company shares |

| EuroTLX | Bonds and certificates |

| Hi-MTF | Market of Italian and foreign equities and bonds listed at particular times |

Let's immediately answer this question in the affirmative . You can buy Banca Sella shares within the Hi-MTF market , a particular type of trading system. Today the term financial markets is considered a place of exchange where, through an authorized broker, you can carry out the purchase and sale of assets.

You will immediately think of the Wall Street stock exchange with the NASDAQ and S & P500 indices , the Italian one in Piazza Affari , the French CAC40 or the Spanish one, as well as the main European and foreign exchanges, defined as regulated markets . The latter are those markets that have the greatest number of assets and those most used. However, there are also other types of financial markets.

For example, you will have heard of the OTC ( over the counter ) market typical of Forex Trading, or the acronym MTA (electronic stock market). Among these is the Hi-MTF . This market brings together a series of Italian and foreign stocks that are traded at particular times and according to rules different from traditional markets, offering ample liquidity of transactions and an immediate order entry system.

How to buy Banca Sella shares

Banca Sella shares are present right on the Hi-MTF, with a trend that is around € 0.73 . What will you have to do if you want to buy them? Meanwhile, you will not be able to do it directly using one of the best online trading brokers .

In fact, if you search in the list of shares you will not find the Banca Sella ticker . However, you will have the opportunity to invest in them in two ways:

- at a branch of the Group;

- through online purchase on a Hi-MTF intermediary.

Then, you will have to go to one of the 600 Banca Sella investment branches , present in over 1,200 branches and ask a financial advisor to buy the bank's shares.

You will have the opportunity to carry out this procedure also online, using a Hi-MTF intermediary . This term identifies a company that offers you the opportunity to access this market and therefore to buy and sell Banca Sella shares.

Investing in the shares of the Sella Group: pros and cons

One clarification is important. The Hi-MTF market is safe and regulated by Consob , but foresees profound differences with the traditional ones.

In fact, if on the one hand you have ample liquidity and a high number of shares and bonds on which to operate, on the other you must consider that the activities are limited to the equity and bond segment.

So if you want to trade with other instruments such as cryptocurrencies or dedicate yourself to CFD trading, you won't be able to do it, but you will have to register with a traditional online trading broker. In addition, the performance of Banca Sella shares, listed on the Hi-MTF, had a growth rate of 17% in 2021, reinforcing the idea of a solid and reliable bank.

On the other hand, you must consider that the forecasts for the next few months stand at -3.39% on the return of 2022. Finally, since they are not listed on traditional markets, it is not always easy to monetize your investment immediately.

Buy shares with Banca Sella and online trading

Now that we have clarified how to buy Banca Sella shares, let's consider whether it is possible to invest in the markets with this credit institution. Again, the answer is yes.

In fact, you will have an online trading account through which you can access an innovative and professional platform called Sella xTrading .

Thanks to this tool, Banca Sella combines all the characteristics of a traditional credit institution: safety, reliability and maximum freedom in managing your money. At the same time, Banca Sella can be included among the best banks to invest online : you will have the possibility to access your online account from any device and activate the trading service in a few clicks.

Where to invest with Banca Sella

With the xTrading platform you can trade:

- actions;

- bonds;

- ETF;

- Derivatives, Certificates and Covered Warrants;

- Commodity.

So, you have accessed the Milan Stock Exchange and the main European squares, from Euronext in Paris to Amsterdam, from the Frankfurt stock exchange to the Spanish one. Additionally, you can trade on foreign markets:

- NYSE: the American stock exchange in which all commodity securities are included;

- NASDAQ: the index containing the most important hi-tech stocks.

Buying shares with Banca Sella: costs

The costs of trading with Banca Sella vary based on a number of factors :

- type of platform;

- fixed or variable commissions;

- operation;

A dynamic solution that reflects the intention to create a tool suitable for the inexperienced retail trader and the more experienced ones, with several monthly executions.

Typology in piattaforma in trading

By opening a Banca Sella trading account, you will have access to two types of platforms :

- xTrading;

- Sella Extreme.

Both allow you to access all markets, but provide for a differentiation of operations. For example, in xTrading you will have real-time charts, but you will not be able to vary the type of display, between bar and candlestick ones. Instead, the Extreme version allows you to customize every single part of the platform, as well as add customized alerts on individual assets.

As for costs, the xTrading version is free, while the Sella Extreme version has a monthly fee of € 20. This can be reset if you perform at least 15 runs per month.

Commissions for investment operations with Banca Sella

| Type of commission | Pussy | Variables |

| Securities deposit cost | Not expected | Not expected |

| Italian Equity | And 8€ at 2,5€ | 0.17% a 0,05% |

| Bond | 12€ a 2,5€ | 0,06% a 0,185% |

| NYSE – NASDAQ | 15€ a 6,5€ | 0,05% a 0,16% |

| Euronext | 8€ a 2,5€ | 0,05% a 0,16% |

| Derivatives | 7€ a 2,5€ | Not expected |

Operating expenses can be fixed or variable . In the first case, a commission will be applied for the purchase and sale established based on the volume of monthly transactions performed. Very advantageous if you operate with a certain frequency and with capital of a certain importance, since you can reach a minimum of 2.5 €.

Instead, with variable commissions , a percentage of the total transaction will be applied. You can use this option if you trade with small amounts, for example if you apply an intraday strategy with several daily trades.

Volume of operations

Finally, the last parameter that will affect the operating costs is that concerning the volume of operations you carry out in a month. There are six different levels:

- below € 100;

- between € 100 and € 350;

- between € 350 and € 500;

- between € 500 and € 1,000;

- between € 1,000 and € 1,500;

- above € 1,500

Once the threshold is reached, the new commission will be applied in the following month.

Banca Sella trader account

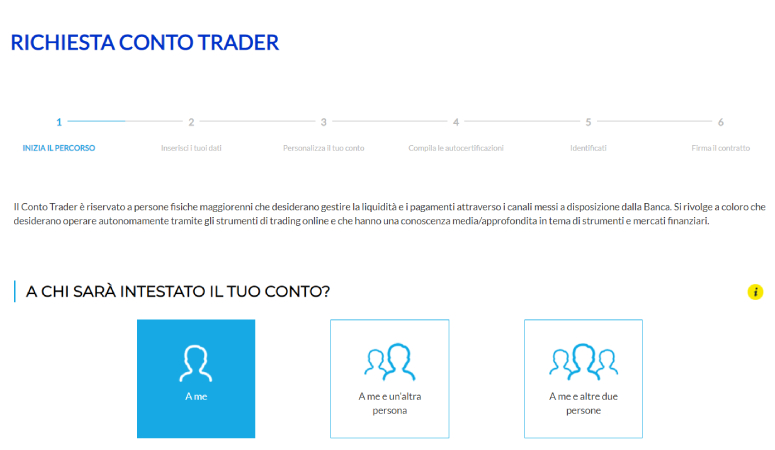

To access the Banca Sella trading service, the first step is to have a Sella Online account . Today two types are available:

- Start account: € 1.5 per month;

- Premium account: € 5 per month.

If you do not have a Sella Online account , we invite you to read our dedicated guide with costs and user reviews. Below you will find out what are the steps to access the trading service. Today, thanks to the continuous innovation by the Banca Sella Group, you will have the possibility to open a new account in a few minutes and using the SPID .

If you use the Digital Identity System, here are the steps:

- enter username, password and verify the OTP code;

- check the entered data;

- accepts the terms of the contract and performs the digital signature.

The procedure is slightly longer if you have to do the operation manually . Here are the main steps:

- choose whether to jointly hold the account up to a maximum of two subjects;

- enter your name, surname, social security number, e-mail and mobile phone;

- verify your identity through the link sent on the e-mail and the OTP code on the mobile phone;

- complete the personal data and those of all co-holders;

- take a photo of your identity document;

- take a video-selfie with your mobile phone;

- accept the terms of the contract;

- choose the type of Sella Online account;

- start investing with the xTrading platform.

How to buy shares with Banca Sella

Thanks to the presence of two types of platforms, the xTrading and the Extreme version , you will be able to trade with all professional tools.

In fact, the basic version includes a webtrader interface . This means that you will not have to install software on your device, but you can open it through any browser on your computer, or using one of the best free trading applications : the xTrading app.

The interface is intuitive, since you will have a board with the list of all available assets: stocks, bonds, ETFs, derivatives and commodities. You will have the possibility to customize your own securities portfolio , by inserting a list of favorites. In addition, you will have several pop-up windows where you can access additional information.

Finally, there are a series of features that are perfect for investing professionally and safely:

- real-time update;

- ability to open multiple windows with title analysis;

- push charts with technical analysis indicators;

- fundamental analysis and news in real time;

- takes intraday and multiday;

- customization of settings.

Extreme saddle version

It is the advanced paid version, with which you can have great depth of the market thanks to real-time charts and more than 100 indicators. In addition, you have the option to customize every single section of the platform.

All changes will be stored automatically in order to have an increasingly direct and intuitive trading experience.

In addition, you will have a number of enhanced features:

- chart trading: you can enter orders directly from the chart in real time, speeding up your trading;

- advanced search: just a few clicks will be enough to immediately obtain the list of assets of a specific market;

- trading accelerator: you can customize the buttons in the purchase book in order to activate particular functions such as stop losses and take profits;

- advanced strategies: you have the possibility to set automatic orders based on your trading strategies;

- algotrading: a service that has a cost of 25 euros, which can be reset if you make 15 trades and which allows you to create your own customized automatic trading system.

Is it worth buying shares with Banca Sella?

Investing in Banca Sella shares can be a valid opportunity, given the solidity of this bank. However, trading on the Hi-MTF market is not always easy and above all it involves a series of limits on the assets you can buy.

For example, if you want to trade Bitcoin or cryptocurrencies, you will need to open another account with a trading broker. On the other hand, as regards the operations through the xTrading and Extreme platforms, the opinions are positive .

In particular, the free basic version is emphasized and the possibility of canceling the monthly cost of the advanced Extreme version if you operate frequently. Several positive comments were also expressed on the technical aspect . In fact, the webtrader version proves to be reliable, competitive and with the opportunity to customize different settings.

The advanced one has a number of very useful features to reach a higher trading level. As far as transaction costs are concerned , even if there is a difference between the fixed and variable option, they are still higher than the average . Furthermore, there is no possibility to invest in emerging markets , or in Forex trading. Finally, there is no demo system to approach the market for those with little experience.

Today, if you want to trade on all assets and with competitive costs, you have several alternatives to investing with Banca Sella, such as the best online trading platforms . In our ranking we place the broker eToro in first place , suitable both if you want to invest professionally, and if you want to operate using the latest automatic trading theologies .

Another advantageous broker is LiquidityX , a platform that offers you one of the best online trading systems with a double interface: web and MetaTrader . Finally, another option is to choose the Capex.com broker .

Posting Komentar untuk "Is it possible to buy Banca Sella shares?"