5 Stocks with High & Consistent Passive Income, What Are They?

Do you want to retire early, do you have a consistent source of income yet? Do not let you retire, uh but 3 more years back to work. You have to prepare assets that provide passive income. One of the assets that can provide passive income is stocks and of course stocks that distribute dividends consistently.

Here we provide 5 stocks with relatively high and consistent passive income which of course these stocks are in the investment coverage list of GaleriSaham:

West Java and Banten Development Bank Tbk (BJBR)

In the last 5 years, BJBR has consistently distributed dividends with a stable payout ratio in the range of +-58%, with yields that are relatively maintained above 6% (check the red line). So that investing in BJBR shares is quite attractive compared to just saving funds in deposits or bonds.

East Java Regional Development Bank Tbk (BJTM)

Almost similar to BJBR, in the last 5 years BJTM has consistently distributed dividends with a stable payout ratio in the range of +-53%, with a relatively maintained yield of above 6%. So investing in BJTM stocks is a pretty interesting choice.

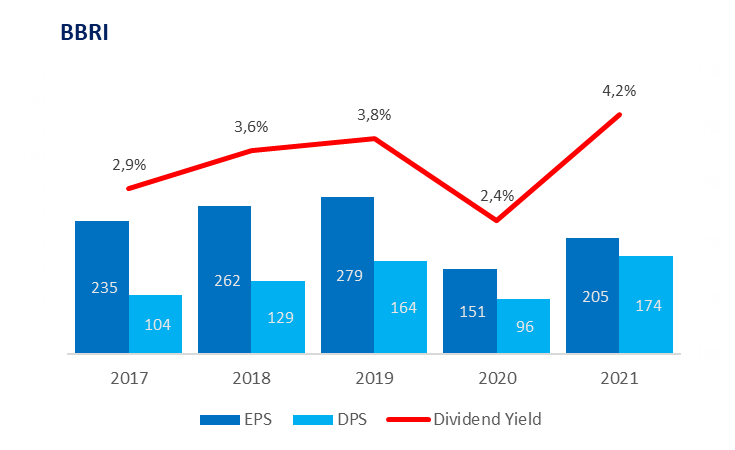

Bank Rakyat Indonesia Tbk (BBRI)

Who doesn't know this stock? One of the blue chip stocks that is quite stable and you can expect the company's business growth will continue to increase in the future. BBRI consistently distributes dividends with an average yield of above 3%.

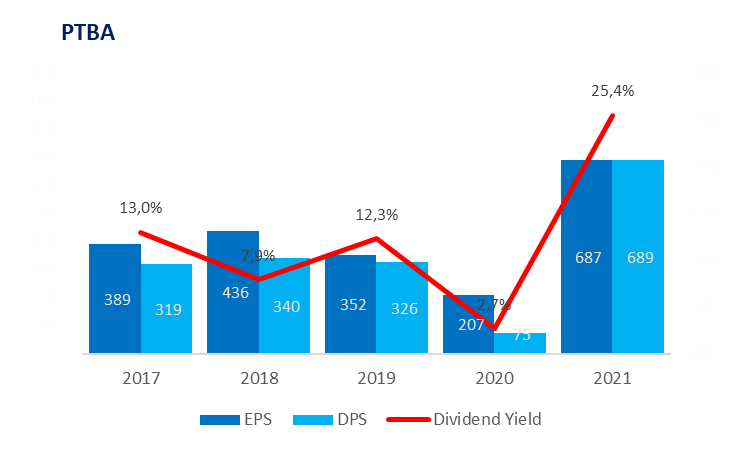

Bukit Asam Tbk (PTBA)

One of the coal stocks that consistently distributes dividends with a fairly high yield in the +-12% range. However, you should also know that these stocks are cyclical, so business performance may fluctuate according to coal prices. FYI, 60% of PTBA's sales are always absorbed by PLTUs in Indonesia.

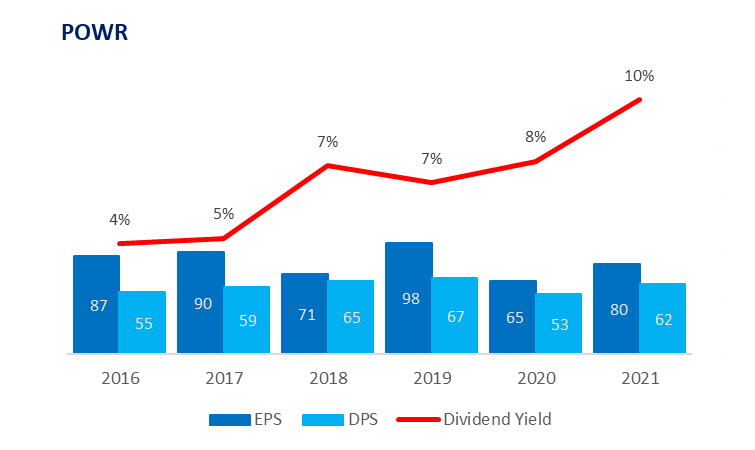

Cikarang Listrindo Tbk (POWR)

The company has always been consistent in paying dividends with an average of 77% of its net profit where the dividend yield in the last 5 years has continued to grow to 10%. You can imagine if this company's business continues to experience growth, then the passive income we get will be even greater, right?

Remember, if you want to retire early, you must have sufficient passive income. If your passive income is still small, it means you don't have much money. So increase your money to be able to have a large passive income. Don't be in a hurry to retire, uh, 3 years back to work again.

So, have you started investing in stocks yet? If so, what are your investment stocks?

Posting Komentar untuk "5 Stocks with High & Consistent Passive Income, What Are They?"