Does If Sales Increase, the Company Makes a Profit?

Series 4: Warren Buffet Strategy ( Cash Flow Statement )

Have you ever read a company's financial statements? Maybe many of us (especially if we are investors) must often read financial reports. Company financial reports such as income statements are financial reports prepared based on accounting methods. So the question is, do high sales on the income statement mean that the company is profitable?

Not necessarily!! Because many companies have increased sales, but are not profitable because the cash generated is less than the cash issued ( negative cash flow ).

So to ascertain whether a company is profitable and generates positive cash, we must look at and analyze the Cash Flow Statement .

There are three parts to this report that you must understand, as follows:

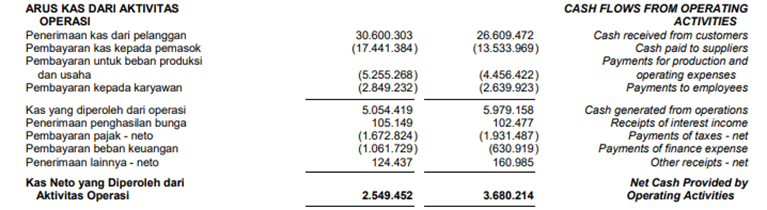

1. Cash flow from operation

In this section, friends can find out how much cash the company can generate from its operational activities, as well as the depreciation and amortization values are re-entered because there is actually no cash issued for these costs.

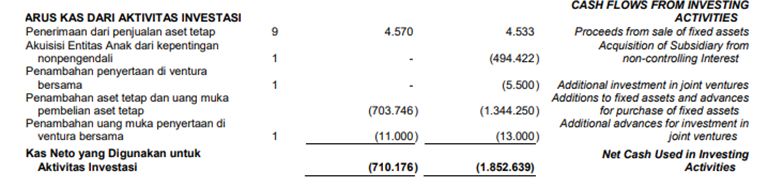

2. Cash flow from investing

In this section, friends can find out how much the company's capital expenditure ( capital expenditure) is to support the company's operations and business development. The value must be negative, because if the value is positive it means the company has sold one of its assets.

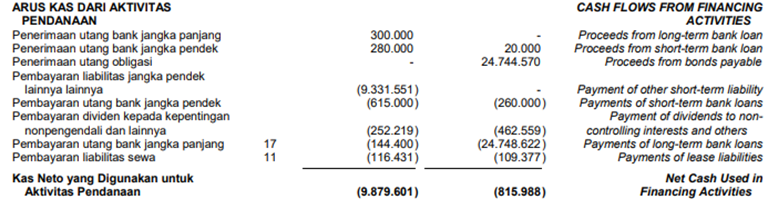

3. Cash flow from financing

In this section, friends can find out how the company's financing activities are, whether the company is increasing its total debt, whether the company is distributing dividends or doing buybacks .

From the explanation above, following are some of the things that Warren Buffett pays attention to to see if a company has a durable competitive advantage:

1. Capital Expenditure (CapEx)

Warren Buffett likes companies that allocate less than 25% of their profits to capital expenditure . This means that the company is able to maintain the continuity of its operations without having to spend a lot of money.

2. Stock Buybacks

Warren Buffett likes companies that do stock buybacks rather than increasing the amount of dividends. The more often the company buys back , it will increase earnings per share for shareholders. The higher the earnings per share , the higher the price of a stock.

After friends know and understand about Warren Buffett's strategy in finding companies with durable competitive advantages , from starting to analyze income statements, balance sheets, to cash flow statements . Do you think this strategy can still be applied to current conditions?

Posting Komentar untuk "Does If Sales Increase, the Company Makes a Profit?"