Series 3 – Does a Good Income Statement Reflect a Company Worth Buying?

After friends get a company that has a durable competitive advantage according to the criteria in the previous series 2 articles regarding income statements . Do you think income statement analysis is sufficient as a basis for us to buy a stock?

What if the company is liquidated in the future because of its inability to pay debts?

What if it turns out that there are lots of uncollectible financing receivables or abundant inventories that will affect the company's future income?

So, to answer questions like the one above, we need to look at and analyze the company's balance sheet , so that we can avoid risks like the one above.

What exactly is a balance sheet report?

So on the balance sheet, friends will find three important aspects, namely assets, liabilities and equity of the company. Of these three aspects, what do friends need to pay attention to? The following are some of the criteria that Warren Buffett is interested in on the balance sheet:

1. Current Assets

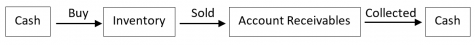

Current assets are working assets that will generate cash for the company going forward. Current assets are assets that can be converted into cash in the short term, such as cash and cash equivalents, inventories and trade receivables.

a. Cash and cash equivalents

Cash and cash equivalents will provide an overview of whether the company is able to generate income that exceeds its expenses. Warren Buffett is looking for companies that have large cash flows with little debt and no selling of assets, and are consistently profitable.

b. Supply

Warren Buffett looks for companies whose total inventory and revenue are correlated. Because, when the company's profit rises, the company will increase total inventory to meet future demand.

c. Accounts receivable

Warren Buffett looks for companies with a lower percentage of accounts receivable to sales than his competitors. This can show the company's ability to generate profits.

2. Fixed Assets

a. Property, Plant, and Equipment

Companies that have a durable competitive advantage do not replace plants and equipment just to compete with competitors. However, the company will only replace plant and equipment when their useful life is over.

b. Long-Term Investments

From this point, Warren Buffett can assess the management of a company because good management will invest in companies that have a durable competitive advantage .

3. Total Debt

Warren Buffett likes companies with little to no debt. This can show that the company is able to generate a lot of cash to finance operations and develop its business in the future. Warren Buffett avoids companies that have a lot of debt, because these companies will focus on how to pay off debt rather than focusing on business development such as expanding.

Several ratios are commonly used by Warren Buffett to find companies with durable competitive advantages , such as:

1. Return on Assets

Return on assets is a ratio that can give an idea of how efficient a company is in using its assets to generate profits. The higher this ratio, the more efficient the company is in managing its assets.

2. Debt to Equity Ratio

Warren Buffett looks for companies with a debt to equity ratio below 0.80 (the lower the better.) Because companies have earning power to finance their operations rather than using debt.

3. Return on Equity

Warren Buffett looks for companies that can provide a high return on equity . The higher the ROE means the company can make good use of its profits.

“High returns on shareholders’ equity means “come play.” Low returns on shareholders’ equity means “stay away.”

Warren Buffett

Those are some of the analyzes conducted by Warren Buffett on balance sheet reports that are proven to give him a company that has a durable competitive advantage .

However, does Warren Buffett's analysis only come to the balance sheet?

Of course not, there is still a cash flow statement that became the basis for Warren Buffett to buy a company. We will discuss the analysis of cash flow statements by Warren Buffett in the last series, okay! Stay tuned!!

Posting Komentar untuk "Series 3 – Does a Good Income Statement Reflect a Company Worth Buying?"