The Greatest Wealth-Investment Strategy in the World – Warren Buffett – Series I

Warren Buffett, who doesn't know this investor? He is the CEO of Berkshire Hathaway and is still the most successful investor in the world today. So it's no wonder, Warren Buffet is known as the " Oracle of Omaha " or "Forecaster of Omaha". With his investment strategy, Warren Buffett was named by Forbes as the richest person in the world in the 1990s. Until now, Warren Buffett is still the richest person in the world. Where Forbes named him the fifth richest person in the world in 2021 with a total wealth of US $ 118 billion.

How did Warren Buffet's journey become the top 5 richest person in the world ?

Warren Buffett started his investment partnership in 1956 called Buffet Partnership, LTD. Over the next 13 years, Buffett managed to multiply his money by 29.5% per year even though the Dow Jones Industrial Average slumped five different years during that period. In 1962, Buffett bought the Berkshire Hathaway company. In 1964, Buffet dissolved the partnership and took control of Berkshire Hathaway for a net worth of $22 million. Forty years later, that value has increased to $69 billion, growing at 22.2% per year.

Buffett's investment concept is the result of Buffett's dedication to Ben Graham, Phil Fisher, John Burr Williams, and Charlie Munger. Graham provides basic knowledge in investing, risk management, and investment psychology. Fisher teaches long-term investing and only focuses on a few good companies. Williams gave him a mathematical model to calculate the true value. Munger helped Buffet appreciate the economic returns that would come from buying and owning great businesses.

What's unique is that when we look at stock trends that are always changing due to the times, Warren Buffet has never changed his method. He is still loyal and continues to consistently use the same principles from when he first started investing.

What are the principles that Warren Buffet always uses?

- Buy stocks as if you own them.

- Focus on your portfolio, just buy stocks that you understand.

- Buy stocks according to your risk profile.

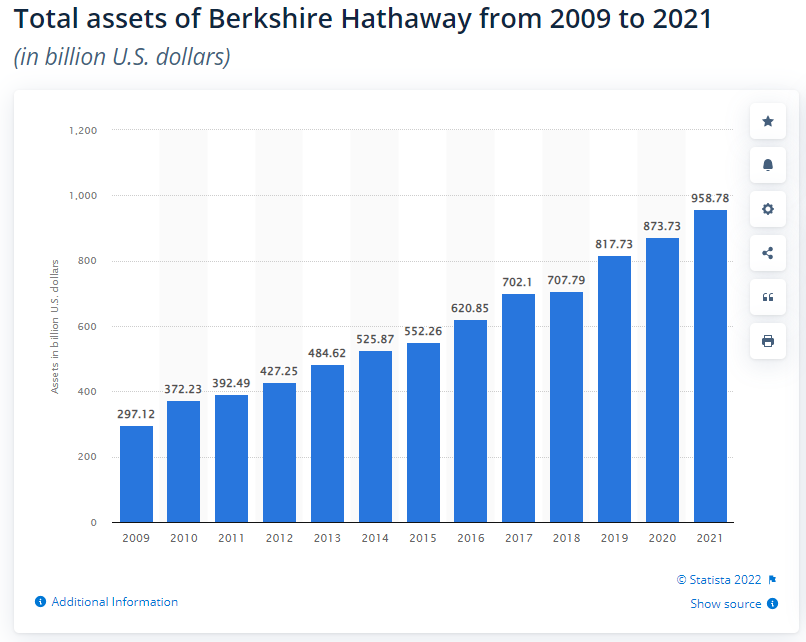

By applying the principles learned by Warrant Buffet, the total assets of Berkshire Hathaway managed to grow from $297.12 billion in 2009 to $958.78 billion in 2021 or a growth of 223%.

One of the oldest stocks held by Warren Buffet to date is Coca-Cola. Buffett started buying Coca-Cola stock in 1988. Coca-Cola stock has increased by more than 2,000%. In the following years, Warren Buffet has always increased his holdings up to 9.2% with an average price of $ 27.13 and has increased more than 147% when the price of Coca-Cola reached an all time high. The key is: be consistent in buying stocks.

With the coffers of wealth that Warren Buffett has managed to accumulate to date, many people are still curious about how Warren Buffett was able to find a wonderful company.

Posting Komentar untuk "The Greatest Wealth-Investment Strategy in the World – Warren Buffett – Series I"